By James Kelly

Centerpoint Securities is an online stock broker that caters to sophisticated day traders looking to gain an edge in the market. The brokerage is a division of Precision Securities LLC, which is a member of FINRA and have been in business since 2000.

Commissions

Centerpoint offers customers three separate commission plans. The standard plan was created for active day traders; charging between $0.002 and $0.004 per share, depending on total trading volume for the month. The all-in plan caters more towards institutional clients, with trades costing anywhere from $0.0065 to $0.0045 per share. Traders who sign up for the per-ticket plan pay between $3.95 to $5.95 per trade. Clients who trade more than four shares million will pay reduced fees per share. Overall the commissions are expensive in comparison to other online stock brokers but as the saying goes “you get what you pay for.”

Opening an Account

Centerpoint Securities is tailored towards high net worth investors who can afford to deposit a significant amount of capital. The minimum deposit required to open an account is $30,000! This figure is a lot higher than the industry average, Interactive Brokers minimum is $10,000 while Etrade’s is $0 for a cash account. Surprisingly, Centerpoint doesn’t have an online application process. Instead, you have to send the required documents by email in a PDF format. Unlike, other well-known brokers, they do accept non-US residents, considering you meet the requirements.

Trading Platforms

Trading Software Fees

Centerpoint has three software tools, each charge a monthly fee, ranging from $120 to $505 per month. The hefty monthly fees can be avoided if you meet the minimum trading volume, this ranges from 200,000 to 1 million shares.

DAS Trader Pro

DAS Trader Pro is the cheapest platform available to customers. The platform provides everything a professional trader needs to make money. It contains an advanced charting tool, fast executions, supports multiple monitors, multiple stop types, real-time level 2 quotes and the latest market news. They also provide data for all the major exchanges including NASDAQ, NYSE, BATS and Direct Edge.

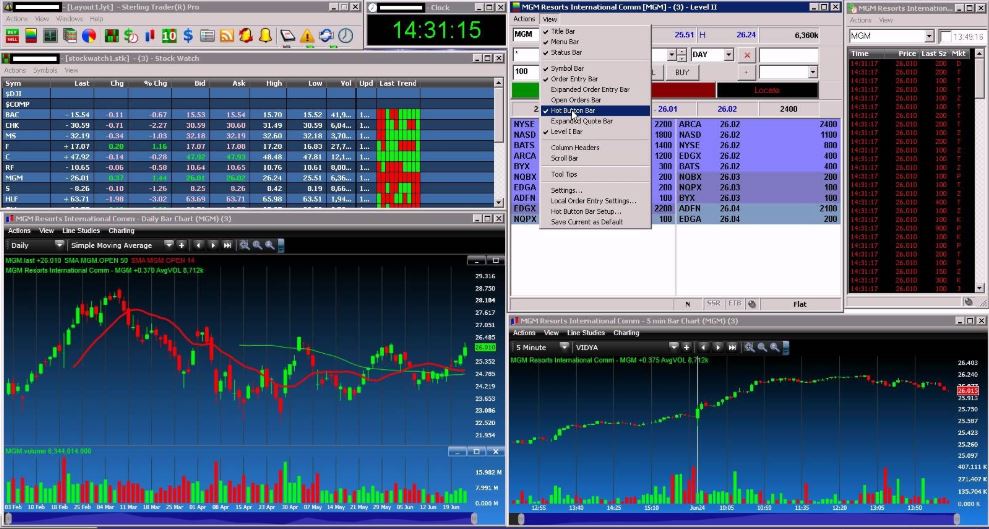

Sterling Trader Pro

Sterling Trader Pro is the second most expensive platform, costing $175 to $235 per month. This is a very sophisticated tool used by experienced traders of options, equities and futures. The platform has real-time level two, basket trading and programmable keys to enable faster trade executions. Programming enthusiasts can leverage the API capabilities to integrate their own software programs. In addition to access to data on all major US exchanges, the software displays data for several foreign stock exchanges – Europe, Brazil, Hong Kong and Shanghai.

RealTick

RealTick is Centerpoints most powerful platform, enabling clients to do everything possible to gain a statistical edge on competition. The pro version is a whopping $505 per month with data feeds included, there is an express version for $205. Both plans offer faster executions, options to optimize trading performance, access to a global broker network and liquidity from dark pools & exchanges. The Pro edition has a mobile app for those wanting follow the latest stock market news from their mobile phones.

Pros

- One of the best brokers for trading penny stocks, experts such as Timothy Sykes, Michael Goode and Tim Grittani use them as a broker. If these traders are recommending Centerpoint then they must be a high end broker.

- Another big advantage is quick trade executions, speed is crucial is on Wall Street. Other online brokers can’t compete, offering bad fills that could cost you hundreds of dollars.

- Have the best borrows making them the number one broker for short selling stocks. The broker works with four clearing firms allowing them to get access to hard to borrow stocks.

Cons

- The company only wants to work with high net worth individuals. This is understandable from a business perspective but the average person can’t afford $30,000 to open an account. Those new to trading will end up using cheaper brokers with slow executions.

- Expensive fees charged, only receive discounts if you trade with large volume.

- Not suitable for beginners and there is limited educational resources.

- Their stock scanning tool is limited so you will need to find a premium screening tool like Trade Ideas, Stockstotrade and Finviz, etc.

My Final Thoughts

Excellent broker used only by elite traders with large account sizes. If you don’t have enough money explore alternative brokerages like Interactive Brokers and Etrade.